With 7x revenue growth and billions in payment volume, the Miami-based fintech startup cements its position as a rising force in infrastructure for vertical SaaS.

Payabli, a fast-scaling payments infrastructure platform, has closed a $28 million Series B round led by Fika Ventures and QED Investors. The funding comes just nine months after the company’s Series A and brings its total capital raised to $60 million.

The round also saw participation from existing investors TTV Capital and Bling Capital, underscoring strong investor conviction in Payabli’s momentum and market position. Over the past year, the company has reported a 7x year-over-year revenue jump and billions in live payment processing volume.

We saw a clear opportunity to go on the offensive. AI is reshaping financial services, and we’re leaning in across our platform and organization to accelerate growth and innovation.

said Joseph Elias Phillips, Payabli Co-Founder and Co-CEO

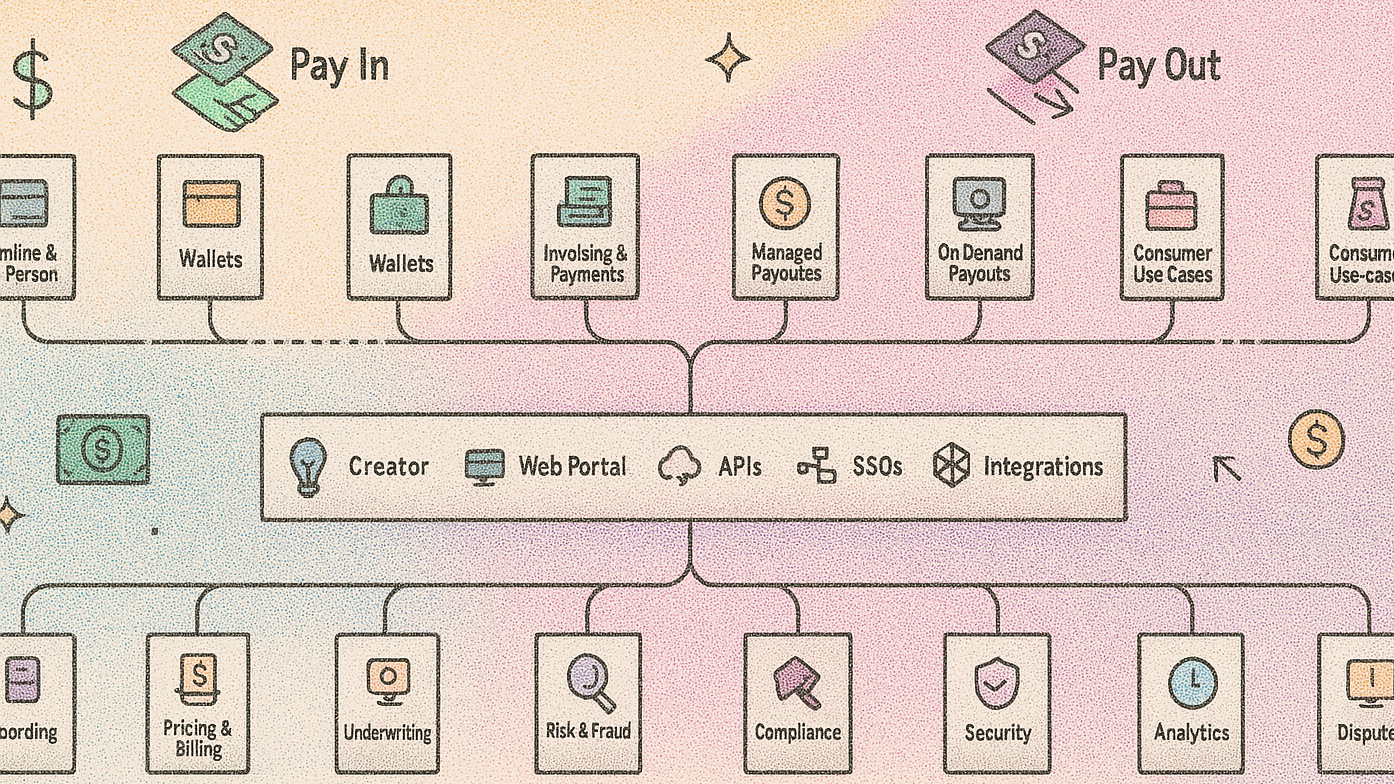

Founded to help software companies monetize and embed payments directly into their products, Payabli offers a full-stack API platform spanning Pay In, Pay Out, and Pay Ops, essentially allowing SaaS companies to become payments companies without taking on payment facilitator (PayFac) complexity.

The firm now serves over 50,000 merchants and has launched embedded payments with some of the largest enterprise clients in so-called need-to-pay verticals. Its infrastructure handles onboarding, payment acceptance, issuance, and reconciliation.

Jo and Will have built the right platform at the right time. As software becomes the next payments frontier, Payabli is emerging as a category leader.

said Laura Bock, Partner at QED Investors

Doubling Down on AI and Product Expansion

The fresh capital will fuel Payabli’s continued investment in AI-powered features to boost customer personalization, operational efficiency, and risk management. The company recently launched Amigo, an AI-powered support agent integrated into its platform, Slack, and documentation, designed to act as everything from a technical support bot to an embedded business analyst.

Additionally, Payabli is working with NVIDIA to develop proprietary fraud and risk models tailored to vertical SaaS clients, eschewing one-size-fits-all tools in favor of custom built intelligence for each sector.

On the product front, Payabli is expanding its 3P suite with the introduction of a new embedded spend management solution. This offering gives platforms the ability to issue branded virtual and physical cards, manage spending rules via API, and capture interchange revenue, positioning software companies to offer finance functionality natively.

Our strategy has always been about unifying the payment lifecycle. With the addition of spend management and On-Demand Payouts, we’re giving platforms full control over their financial stack.

said William Corbera, Payabli Co-Founder.

Scaling a Team and Culture From Miami

Headquartered in Miami, Payabli is building a remote-first, nationally distributed team. The company was recently named to Inc.’s Best Workplaces of 2025, reflecting its commitment to culture, employee engagement, and mission driven growth.

With the new funding, Payabli plans to hire across engineering, product, GTM, AI, and customer success, cementing its presence as a breakout fintech company in South Florida’s growing startup ecosystem.