South Florida is on the cusp of sweeping micro-mobility reform as cities across the region prepare to implement age limits for electric bikes and scooters, following the passage of a new state law granting local governments the authority to regulate who can ride.

Senate Bill 462, signed into law by Gov. Ron DeSantis, goes into effect July 1 and gives municipalities the power to set minimum age requirements, ID rules, and safety training standards for e-bike and scooter riders. The bill was inspired by the tragic death of Megan Andrews, a longtime Key Biscayne resident who was killed in February 2024 after a 12-year-old on an electric bike collided with her while she was cycling.

The Village of Key Biscayne had already enacted a full ban on micro-mobility vehicles following the accident, but now officials and cities across the region have the legal authority to tailor policies with age restrictions and safety rules.

Age Limits Coming to a City Near You

The implications of SB 462 reach far beyond Key Biscayne. Other South Florida municipalities, including Miami, Coral Gables, and Fort Lauderdale, already wrestling with micro-mobility congestion and safety concerns, now have a green light to follow suit.

Some cities are expected to act quickly. Miami Beach has long debated stricter scooter rules. Coral Gables has voiced concern over underage riders on Miracle Mile. And Fort Lauderdale has faced repeated incidents involving high speed scooters in pedestrian zones.

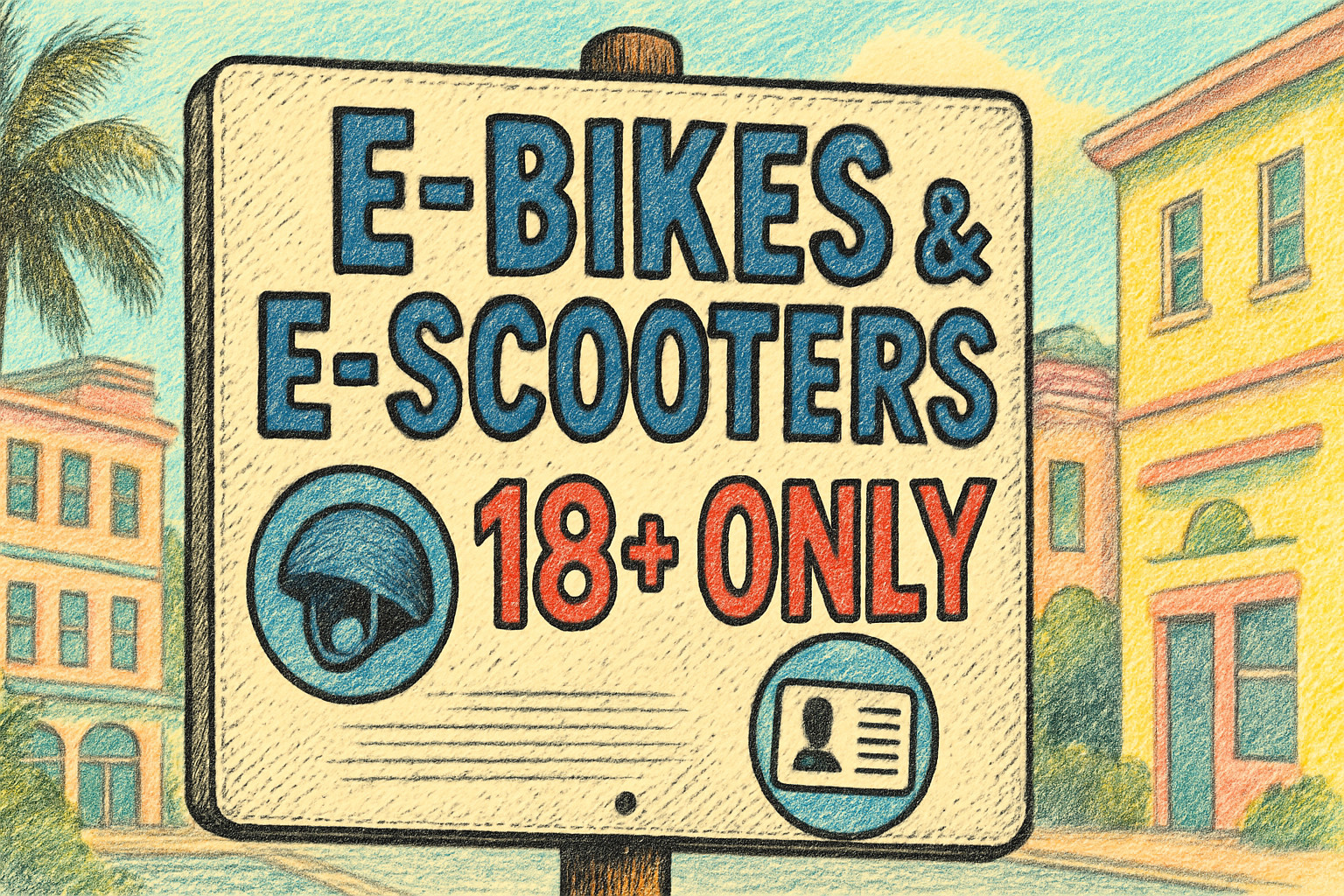

With SB 462 now law, South Florida may soon see a patchwork of age limit regulations emerge, potentially standardizing around 16 or 18 years old.

What It Means for South Florida Startups

The rollout of age limit laws could have ripple effects across South Florida’s fast growing mobility startup ecosystem. For e-bike and scooter startups, especially those piloting in urban corridors like Wynwood, Downtown Miami, and Las Olas, the new municipal powers could impact customer bases, usage data, and investor confidence.

Startups like Veo, Bird, Super73, and smaller local players that rely on youth ridership may need to recalibrate operations, marketing strategies, and fleet deployments. Some might explore new product lines, such as lower speed models designed for compliance or subscription models for verified adult users. Others may push for standardized rules to avoid a city-by-city compliance maze.

It’s also an opening for safety focused ventures: companies offering rider education platforms, smart helmets, or AI-driven incident detection could find new demand from cities aiming to implement the law’s training provisions.