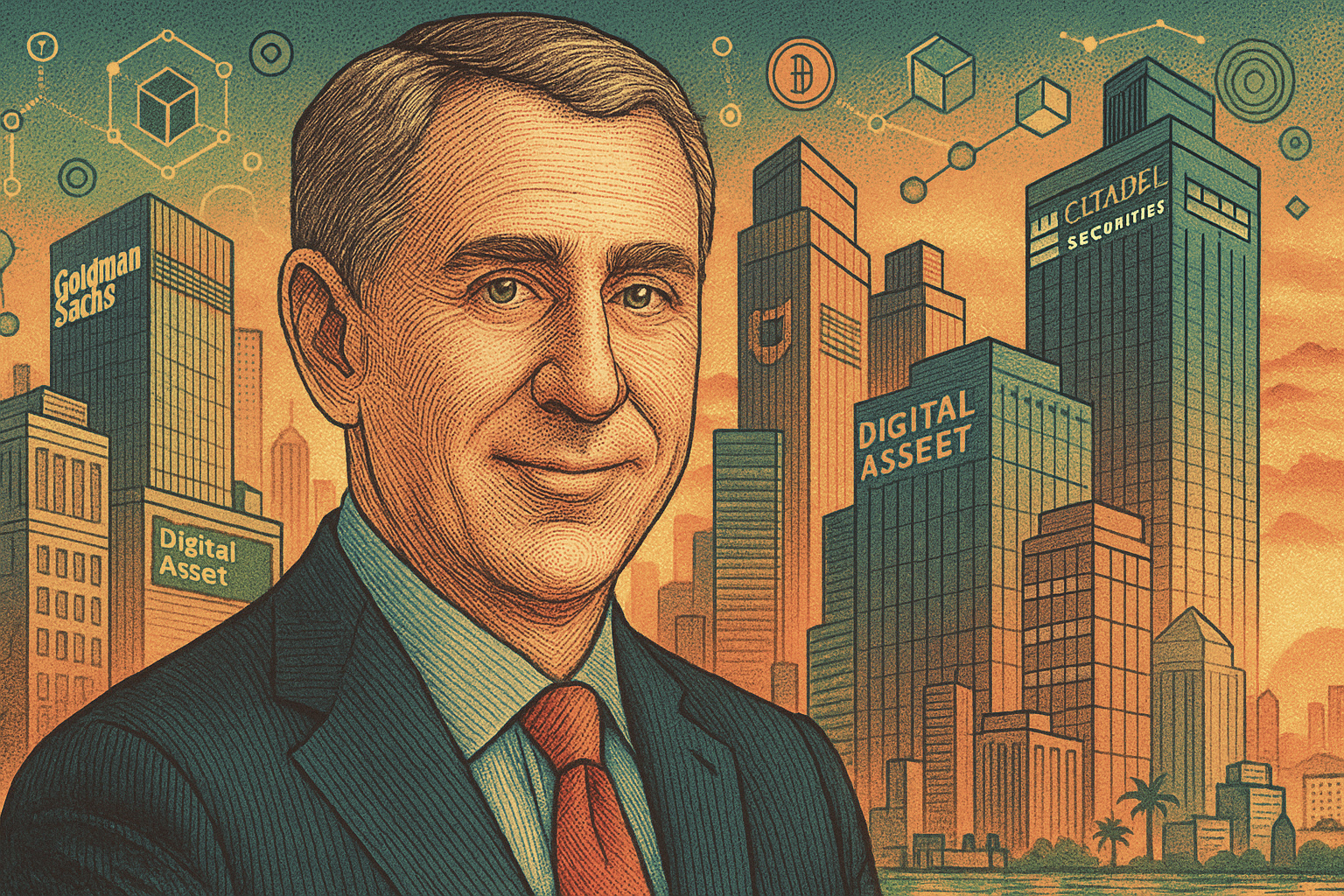

Citadel Securities, the market making firm with its global headquarters in Miami, has joined the $135 million investment round. The firm is controlled by billionaire hedge fund titan Kenneth C. Griffin, signaling a notable institutional endorsement of blockchain infrastructure.

The round, co-led by DRW Venture Capital and Tradeweb Markets, underscores the growing institutional momentum behind the Canton Network, a public, permissionless Layer-1 blockchain built specifically for financial markets. The network is designed to support institutional grade compliance, scalability, and critically configurable privacy.

Participants in the round include Goldman Sachs, BNP Paribas, Virtu Financial, Circle Ventures, The Depository Trust & Clearing Corporation (DTCC), Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, Optiver, IMC, and Liberty City Ventures.

Digital Asset, founded in 2014, is the architect behind Canton, which already supports a broad set of tokenized real world assets (RWAs), from bonds and money market funds to commodities, repurchase agreements, mortgages, and annuities. The new capital will accelerate efforts to integrate hundreds of billions of dollars in additional RWAs onto the network.

This funding milestone validates the inevitability of what we envisioned years ago: a privacy enabled public blockchain designed specifically for institutional adoption. Canton is already actively supporting numerous asset classes and this raise will accelerate onboarding even more real world assets, finally making blockchain’s transformative promise an institutional scale reality.

said Yuval Rooz, co-founder and CEO of Digital Asset.

Citadel Securities’ participation marks a notable endorsement. The Miami headquartered firm is one of the world’’’s largest market makers and is owned by Kenneth C. Griffin, the founder and CEO of Citadel LLC, with an estimated net worth of $42.2 billion. Griffin has become an influential figure in American finance and politics, and his firm’s investment signals increasing alignment between Wall Street incumbents and blockchain native infrastructure.

Today, major players from crypto and traditional finance have joined Digital Asset on its mission to catalyze the next evolution in markets. With trillions of dollars’ worth of real world assets already leveraging the Canton Blockchain, this next round of funding creates significant momentum for the company, and cements Canton as the de facto protocol for global collateral mobility.

said Don Wilson, CEO of DRW.

Digital Asset and Canton are addressing real world challenges in financial markets, not just theoretical concepts. The fact that such a wide range of asset classes are already integrated onto Canton is an important sign that this network is ready for mainstream finance.

said Billy Hult, CEO of Tradeweb.

The investment also reinforces a growing trend: Wall Street is no longer cautiously circling blockchain, it’s building on it. As traditional institutions seek compliant, scalable blockchain solutions, platforms like Canton are rapidly positioning themselves as foundational layers.